The 12 Best Identity Verification Software Solutions for 2026

In a digital-first world, confirming someone is who they claim to be is more than a compliance checkbox; it's the foundation of trust and security. From preventing fraud on marketplaces to meeting strict KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations in finance, the stakes have never been higher. Yet, a clunky, slow, or inaccurate verification process can turn away legitimate customers and harm your bottom line. This guide cuts through the noise, offering a detailed breakdown of the 12 best identity verification software platforms available today.

We'll analyze their core features, real-world use cases, pricing models, and crucial limitations to help you make an informed decision that balances robust security with a seamless user experience. For financial institutions and tech companies, integrating a powerful IDV solution is a non-negotiable part of their digital strategy. Leveraging expert Fintech software development services is crucial for innovation and compliance, with identity verification forming a core component of that custom infrastructure.

This resource is designed for a broad audience, including compliance officers, trust and safety teams, journalists, educators, and platform moderators. Each entry in our list provides an honest assessment, complete with screenshots, direct links, and a concise verdict to help you quickly identify the ideal solution. Whether you need to verify identities for a peer-to-peer marketplace, secure a high-stakes financial transaction, or ensure academic integrity, this comprehensive review will equip you with the knowledge to choose the right partner for your specific needs. We go beyond generic feature lists to provide practical insights that will guide your selection process.

1. Stripe Identity

Stripe Identity is a powerful, developer-first identity verification solution tightly integrated into the Stripe ecosystem. It excels for businesses already using Stripe for payments, such as marketplaces, fintech startups, and online platforms, offering a seamless way to verify user identities for KYC/AML compliance, fraud prevention, and user onboarding. The platform provides a clean, hosted verification flow that can be implemented with just a few lines of code, significantly reducing development overhead.

It supports document verification (passports, driver's licenses) from over 100 countries and includes biometric selfie checks with liveness detection to prevent spoofing. A key advantage is its transparent, pay-as-you-go pricing, making it accessible for startups and businesses with fluctuating verification volumes. While its feature set is more streamlined than some enterprise-focused competitors, Stripe Identity offers one of the best identity verification software experiences for platforms prioritizing speed, simplicity, and integration with payment processing.

Key Features & Analysis

- Verification Methods: Utilizes government-issued ID scanning and selfie biometrics with liveness checks. The system is adept at catching basic fraudulent attempts, though for advanced cases, it's wise to understand the manual steps needed to spot fake IDs.

- User Experience: Offers a pre-built, mobile-responsive UI that can be embedded directly into an app or website, minimizing design and development work.

- Integration: Native integration with the Stripe Dashboard and APIs provides a unified view of payments and identity data. Webhooks allow for real-time notifications of verification outcomes.

- Pricing: Transparent per-verification pricing, with a free tier for the first 50 verifications each month.

| Pros | Cons |

|---|---|

| Excellent developer documentation and APIs | Fewer advanced AML/KYC features than competitors |

| Pay-as-you-go pricing is ideal for startups | Pricing can be less competitive at very high volumes |

| Seamless integration with the Stripe payments platform | Customization of the user flow is limited |

Verdict: Stripe Identity is the top choice for businesses already embedded in the Stripe ecosystem that need a fast, reliable, and easy-to-implement ID verification solution.

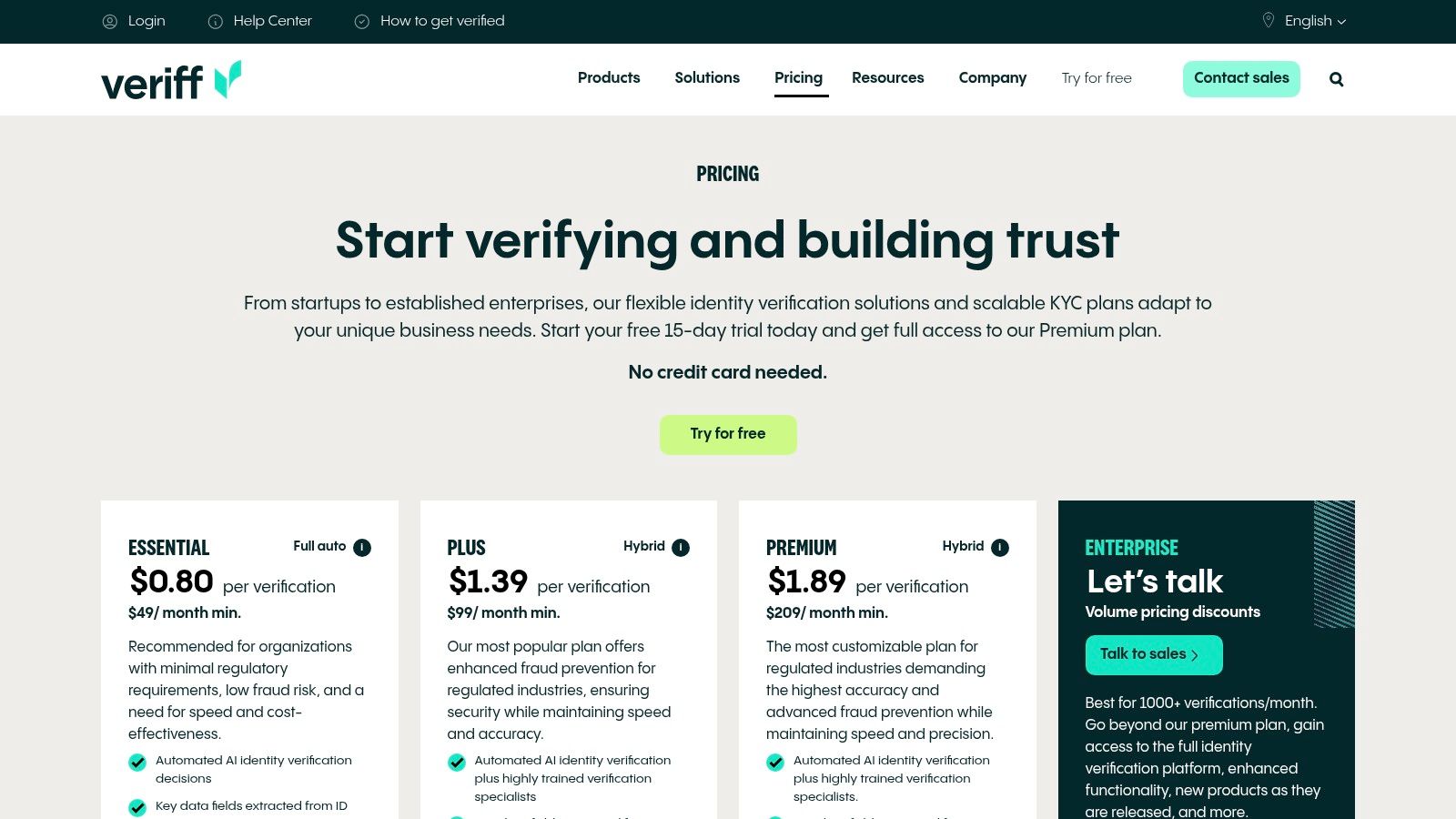

2. Veriff

Veriff offers a flexible identity verification platform known for its extensive global reach and transparent, self-serve pricing model. It caters to a wide range of businesses, from fast-growing startups to regulated financial firms, by providing both fully automated AI-powered verification and a hybrid model that includes human review. This approach allows companies to balance speed with accuracy, making it an excellent choice for platforms that need to support users across diverse geographies and document types.

The platform supports over 11,000 government-issued documents from more than 230 countries and territories, with a user interface available in 48 languages. Veriff stands out with its detailed analytics dashboard and hosted verification pages, which simplify implementation. Its commitment to fraud prevention is evident through features like liveness detection and FaceBlock, which prevents users from using static images or screen recordings, a crucial defense against sophisticated fraud attempts like those from a deepfake image maker. This makes it one of the best identity verification software options for global-first companies.

Key Features & Analysis

- Verification Methods: Utilizes a combination of document verification, biometric analysis with liveness detection, and optional video session recordings. Offers both fully automated and hybrid (AI + human expert) review options.

- Global Coverage: Extensive support for thousands of documents from over 230 countries and territories, with a multilingual user flow that adapts to the user's location.

- Integration: Provides hosted verification pages for quick setup, along with robust SDKs for mobile and web integration. A detailed dashboard offers analytics and manual review capabilities.

- Pricing: Features a 15-day free trial and public per-verification pricing. The model is user-friendly, as it only charges for completed sessions, not for user retries.

| Pros | Cons |

|---|---|

| Transparent, publicly available pricing with a free trial | Monthly minimum commitments apply to paid plans |

| Extensive global document and language support | Advanced enterprise features require sales engagement |

| Charges only for completed verifications, not attempts | May be more feature-rich than needed for simple use cases |

Verdict: Veriff is an ideal choice for global businesses that require broad document coverage, language support, and the flexibility of both automated and human-assisted verification, all within a transparent pricing structure.

3. Jumio

Jumio is an enterprise-grade identity verification and risk management platform designed for global organizations that require high-assurance identity proofing and comprehensive compliance screening. It stands out by combining ID and document verification with ongoing AML monitoring and risk signal analysis, making it a powerful solution for regulated industries like financial services, gaming, and healthcare. The platform leverages a massive identity graph and advanced AI to verify users, detect fraud, and ensure compliance on a global scale.

With support for over 5,000 ID types from more than 200 countries and territories, Jumio offers one of the most extensive document coverages on the market. Its orchestration layer allows businesses to create sophisticated, risk-based workflows that can cascade through different verification methods and data sources. While its quote-based pricing is geared toward larger enterprises, Jumio provides one of the best identity verification software suites for businesses needing a scalable, all-in-one solution for global identity proofing and risk management.

Key Features & Analysis

- Verification Methods: Offers a multi-layered approach including ID document scanning, certified liveness detection, biometric facial recognition, and address verification. Its AML screening checks against global sanctions and watchlists.

- User Experience: Provides a configurable, low-code user journey that can be integrated into web and mobile applications, guiding users through the verification process step-by-step.

- Integration: Features a robust API and SDKs for deep integration, along with a no-code orchestration platform to build and manage complex verification workflows.

- Pricing: Operates on a custom, quote-based pricing model tailored to verification volume, geographic coverage, and the specific modules required (e.g., AML screening).

| Pros | Cons |

|---|---|

| Extensive global ID document coverage (5,000+) | Quote-based pricing lacks transparency for smaller businesses |

| Combines ID verification with integrated AML screening | Advanced modules can significantly increase the total cost |

| Highly scalable for enterprise-level transaction volumes | May be overly complex for simple use cases |

Verdict: Jumio is the ideal choice for large, global enterprises in highly regulated industries that need a robust, all-in-one platform for identity verification, fraud detection, and ongoing AML compliance.

4. Trulioo

Trulioo offers a comprehensive global identity platform designed for businesses requiring extensive international coverage for KYC (Know Your Customer), KYB (Know Your Business), and AML (Anti-Money Laundering) compliance. It stands out by combining documentary and non-documentary verification methods through a single API, allowing businesses to create flexible, layered identity checks. This makes it a top choice for global financial institutions, payment providers, and online marketplaces that need to verify diverse user bases across different regulatory landscapes.

The platform provides access to hundreds of data sources for electronic identity verification (eIDV) and a vast library of over 14,000 document templates. Businesses can orchestrate these checks to optimize for conversion rates and compliance costs, starting with less intrusive data checks before escalating to document and biometric verification if needed. This modular approach, managed from a central dashboard, provides a powerful and scalable solution, solidifying its position as one of the best identity verification software options for enterprises with complex global needs.

Key Features & Analysis

- Verification Methods: Combines electronic identity verification (eIDV) against authoritative data sources with traditional document scanning and biometric liveness checks. Its fraud intelligence capabilities add another layer of risk assessment.

- User Experience: Offers a hosted UI and flexible SDKs for a seamless integration into existing onboarding flows. The developer portal provides robust documentation to accelerate implementation.

- Integration: A single API provides access to its entire global network of data sources and verification services, simplifying technical integration and ongoing management.

- Pricing: Pricing is customized and provided via sales consultation, tailored to the specific services, volumes, and geographic regions a business requires.

| Pros | Cons |

|---|---|

| Exceptional global reach and data source coverage | Pricing is generally sales-quoted and not transparent |

| Flexible mix-and-match documentary and data checks | Best value is typically realized at enterprise scale |

| Powerful single API and orchestration platform | May be overly complex for small businesses with simple needs |

Verdict: Trulioo is the ideal solution for large, multinational organizations that require a highly flexible and scalable identity verification platform with unparalleled global data and document coverage.

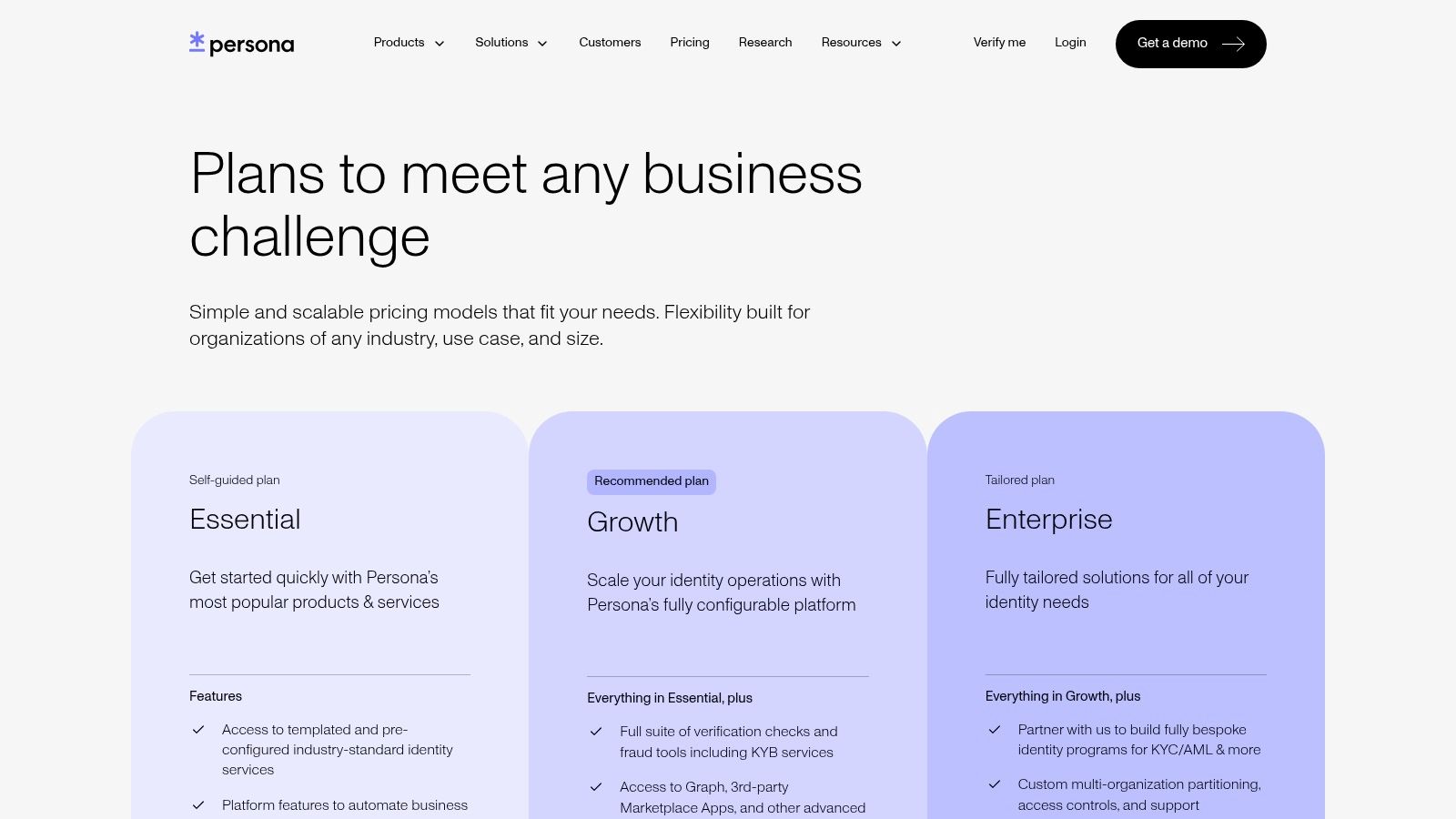

5. Persona

Persona positions itself as a comprehensive and highly configurable identity infrastructure platform, going beyond simple checks to offer a full suite of KYC, KYB, and AML tools. It’s an ideal solution for businesses that require deep customization, from fintech and crypto to marketplaces and trust & safety teams. The platform’s strength lies in its no-code workflow builder and robust case management tools, allowing non-technical users to design and manage complex verification flows and investigate suspicious activity with ease.

Persona combines government ID and selfie verification with database checks, watchlist screening, and adverse media monitoring into a unified system. Its unique Graph feature helps teams visualize connections between users to uncover fraud rings and sophisticated bad actors. While enterprise-level features require a custom quote, Persona offers a public "Essential" plan and startup-friendly programs, making it an accessible yet powerful contender in the best identity verification software space. Its focus on orchestration and investigation sets it apart for companies with complex compliance and risk management needs.

Key Features & Analysis

- Verification Methods: A comprehensive suite including government ID, selfie biometrics, database checks (e.g., AAMVA), and continuous monitoring against AML watchlists and adverse media. It provides a layered approach to verifying images for authenticity and user-provided data.

- User Experience: Features a low-code/no-code "Inquiry Flow" builder for creating customized, hosted verification experiences without extensive engineering resources.

- Integration: Offers a powerful case management dashboard, Graph for link analysis, and a marketplace of third-party integrations to automate workflows and enrich data.

- Pricing: An "Essential" plan is publicly available with a pay-per-successful-verification model, which is more cost-effective than paying for attempts. Enterprise plans are quote-based.

| Pros | Cons |

|---|---|

| Highly configurable with a no-code workflow builder | Per-verification unit price not fully public beyond plan minimums |

| Robust case management and investigation tools | Enterprise-level features require engagement with sales |

| Pay-per-successful verification model is SMB-friendly | Could be overly complex for basic ID check needs |

Verdict: Persona is the best choice for businesses needing a flexible, all-in-one identity platform with powerful workflow automation and case management tools for in-depth risk and compliance operations.

6. Socure

Socure offers an AI-powered identity verification and fraud prevention platform that excels in the US market, particularly for organizations needing to verify diverse and hard-to-reach populations. Its core strength lies in its multi-layered approach, combining predictive document analysis with non-documentary methods that draw from over 400 authoritative data sources. This makes it an exceptional choice for financial institutions, government agencies, and fintech companies that require high assurance and inclusivity, especially for "thin-file" individuals like Gen Z or recent immigrants.

The platform is engineered to deliver high auto-approval rates without increasing risk, leveraging a persistent digital identity graph to recognize returning users. Socure’s emphasis on explainable AI provides clear reason codes for verification decisions, simplifying compliance with Customer Identification Program (CIP) and KYC regulations. For businesses that cannot afford to turn away legitimate customers due to a lack of traditional credit history, Socure provides one of the best identity verification software solutions by tapping into a broader range of identity signals.

Key Features & Analysis

- Verification Methods: Utilizes both predictive document verification (DocV) with selfie biometrics and a non-documentary approach that cross-references data from credit bureaus, utilities, and telcos. It also analyzes phone, email, address, and device intelligence.

- User Experience: Delivers results via API, allowing for full customization of the front-end user journey. The platform provides detailed dashboards with analytics and auditable reason codes for manual review teams.

- Integration: Primarily API-driven for flexible integration into existing onboarding workflows. It is designed to work within complex enterprise tech stacks.

- Pricing: Custom quote-based pricing tailored to specific modules, transaction volumes, and use cases.

| Pros | Cons |

|---|---|

| Industry-leading for verifying thin-file and hard-to-ID populations | Pricing is not transparent and requires a sales consultation |

| High auto-approval rates with low fraud risk | May be overly complex for startups needing a simple solution |

| Strong focus on KYC/AML compliance and explainability | Some advanced modules may need to be purchased as a bundle |

Verdict: Socure is the ideal choice for US-based, highly regulated enterprises that need to maximize customer acquisition by accurately verifying a diverse population, including those underserved by traditional identity systems.

7. LexisNexis Risk Solutions (InstantID + TrueID)

LexisNexis Risk Solutions offers a multi-layered, enterprise-grade identity verification suite ideal for high-risk and highly regulated industries like finance, insurance, and government. Its approach combines two core products: InstantID, which leverages vast public and proprietary data sources to validate user-provided information, and TrueID, which adds document authentication and biometric verification. This dual capability allows organizations to build flexible, risk-based workflows that can escalate from simple data checks to full document-and-selfie proofing.

The platform stands out for its deep U.S. data assets and its ability to incorporate device and behavioral intelligence for a more holistic risk assessment. Supporting over 6,800 global ID types, it provides one of the most comprehensive document libraries available. While the complexity and quote-based pricing model are better suited for large enterprises than for startups, LexisNexis provides some of the best identity verification software for organizations requiring high-assurance, customizable, and compliant identity proofing at scale.

Key Features & Analysis

- Verification Methods: Combines non-documentary verification (InstantID) against extensive U.S. databases with document authentication (TrueID) and biometrics. Also includes device and behavioral signal analysis.

- User Experience: Deployment is highly flexible, with options for SDKs, web services, and even on-premises solutions, allowing for deep integration into existing enterprise systems. The end-user flow can be customized based on risk levels.

- Integration: Primarily API-driven, designed for complex enterprise environments. Integrations often require dedicated development resources to implement effectively.

- Pricing: Available on a quote-only basis, tailored to specific use cases, transaction volumes, and the combination of products used.

| Pros | Cons |

|---|---|

| Deep U.S. data assets and mature enterprise tooling | Pricing is quote-based and integrations can be complex |

| Extensive and frequently updated document library | Some products are not FCRA consumer reports and have usage restrictions |

| Strong fit for public-sector and financial services | May be overly complex for small to medium-sized businesses |

Verdict: LexisNexis Risk Solutions is a top-tier choice for large enterprises in regulated sectors that need a comprehensive, multi-layered identity proofing and risk management platform.

8. Mitek (Mobile Verify + MiPass)

Mitek is a long-standing leader in digital identity verification, offering robust solutions tailored for enterprise clients, particularly in financial services and marketplaces. The company provides a dual offering: Mobile Verify for initial identity proofing and MiPass for ongoing biometric authentication. This combination allows businesses to not only onboard users securely but also to re-verify them throughout the customer lifecycle using advanced face and voice recognition, making it a comprehensive choice for high-risk environments.

Mitek’s strength lies in its patented mobile capture technology, which excels at document scanning and authenticity checks. The MiPass solution adds a powerful layer of security with multi-modal biometrics, including voice and facial liveness, to prevent sophisticated spoofing attacks. While its focus is on enterprise-level deployments, Mitek provides one of the best identity verification software suites for organizations needing both strong initial KYC and continuous, passwordless authentication.

Key Features & Analysis

- Verification Methods: Utilizes high-performance ID document capture (Mobile Verify) with extensive automated authenticity checks. MiPass offers multi-modal biometrics including face matching, voice recognition, and liveness detection.

- User Experience: Delivers a guided image capture experience designed to maximize success rates on mobile devices. The process is optimized to reduce user friction during document and selfie submission.

- Integration: Primarily offered through mobile SDKs and APIs for deep integration into enterprise applications and existing workflows.

- Pricing: Pricing is not publicly listed and requires direct engagement with the sales team, reflecting its enterprise focus. Models can include per-verification or per-user licensing.

| Pros | Cons |

|---|---|

| Strong reputation in financial services and enterprise | Pricing is not transparent and requires sales contact |

| Combines initial proofing with ongoing authentication | May be too complex for small businesses or startups |

| Advanced multi-modal biometric capabilities | Focus can feel more on authentication than full KYC orchestration |

Verdict: Mitek is an excellent choice for large enterprises, especially in banking and fintech, that require a sophisticated, layered approach combining initial IDV with ongoing biometric authentication for enhanced security.

9. AU10TIX

AU10TIX is a pioneering force in the identity verification space, offering a highly automated and forensically-backed platform ideal for high-risk industries like fintech, crypto, and gaming. It stands out with its robust capabilities in detecting sophisticated fraud, including deepfakes and injection attacks. The platform is designed for rapid integration and provides a comprehensive suite of services, from initial ID verification to ongoing Know Your Business (KYB) and AML screening, making it a powerful choice for businesses needing layered security.

With global coverage and extensive forgery tests, AU10TIX delivers near-instant verification results, typically in under 8 seconds. A key differentiator is its use of consortium fraud data, which helps identify serial fraudsters attempting to create multiple accounts across different platforms. For companies battling modern, AI-driven fraud threats, AU10TIX offers one of the best identity verification software solutions focused on forensic-level document and biometric analysis.

Key Features & Analysis

- Verification Methods: Advanced ID verification with liveness and face matching, backed by deepfake and injection attack detection. It also leverages serial fraud detectors and offers add-ons for Proof of Address and AML screening.

- User Experience: Offers a fast, automated flow for end-users, with case management and dynamic workflow tools on the backend for operational teams to manage exceptions and complex cases.

- Integration: Provides flexible integration options through APIs to fit into various tech stacks, enabling businesses to deploy verification quickly within their existing onboarding processes.

- Pricing: While specific per-verification pricing requires a sales consultation, AU10TIX is transparent about a monthly minimum commitment, starting around $500/month for its standard plan.

| Pros | Cons |

|---|---|

| Strong anti-deepfake and modern fraud detection | Per-verification pricing is not publicly listed |

| Fast processing times for a better user experience | $500/month minimum may be a barrier for very small startups |

| Dynamic workflow and case management capabilities | Advanced features might rely on hybrid or manual review |

Verdict: AU10TIX is an excellent choice for high-volume, high-risk businesses that require top-tier protection against sophisticated fraud like deepfakes and serial abuse, especially in the fintech and gaming sectors.

10. Sumsub

Sumsub is an all-in-one identity verification and compliance platform designed for businesses that need a comprehensive KYC/KYB and AML solution from the outset. It stands out with its transparent, self-serve pricing and a powerful feature set that includes liveness checks, sanctions screening, and ongoing monitoring. This makes it an excellent choice for fintech, gaming, and crypto startups that require robust compliance capabilities without the opaque pricing structures common in the enterprise space.

The platform provides a full-cycle verification flow, covering document and biometric checks, address verification, and screening against global watchlists. A unique feature is the "Sumsub ID," a reusable digital identity that allows users to re-verify with partners in the Sumsub network almost instantly, significantly speeding up future onboarding processes. For companies seeking one of the best identity verification software options that combines user-friendliness with deep compliance, Sumsub presents a compelling package.

Key Features & Analysis

- Verification Methods: Offers a complete suite including ID document scanning, biometric liveness and face match, phone/email checks, and proof of address verification.

- Compliance Suite: Integrates AML screening, transaction monitoring, and adverse media checks directly into the verification workflow, providing a single platform for risk management.

- User Experience: Features a customizable and user-friendly verification flow that can be integrated via SDKs, API, or a hosted link. A free sandbox environment and trial period allow for thorough testing.

- Pricing: Publishes clear per-check and monthly pricing on its website, a rarity in the industry. Plans are structured to charge only for successful verifications, which is advantageous for growing companies.

| Pros | Cons |

|---|---|

| Transparent, publicly available pricing plans | Monthly minimum commitments apply ($149–$299) |

| Comprehensive AML and KYB features are built-in | Add-on features can increase the effective per-check cost |

| Reusable identity feature speeds up user onboarding | May be overly complex for businesses needing simple ID checks only |

Verdict: Sumsub is the ideal solution for startups and scale-ups in regulated industries that need a powerful, all-in-one KYC/AML platform with predictable pricing and a strong feature set.

11. TransUnion TruValidate

TransUnion TruValidate is a heavyweight identity verification and fraud prevention suite that leverages the massive data assets of one of the world's leading credit bureaus. It is particularly effective for organizations in finance, public sector, and other high-risk industries that need deep identity insights beyond simple document checks. The platform excels by combining traditional identity data with device, behavioral, and digital intelligence to create a comprehensive risk profile for each user during onboarding.

This solution goes beyond standard verification by orchestrating signals from multiple sources, including document verification with passive liveness checks and selfie matching. A key differentiator is its powerful fraud analytics engine, which draws from a vast network of fraud and identity data to spot sophisticated threats. For businesses needing one of the best identity verification software solutions with an emphasis on robust US data and public-sector compliance, TruValidate offers a compelling, data-rich approach to digital trust.

Key Features & Analysis

- Verification Methods: Utilizes a powerful blend of document verification, selfie biometrics with passive liveness, and identity verification against TransUnion’s extensive US and global datasets.

- User Experience: The solution is API-driven and designed for backend integration, allowing businesses to build their own custom user flows while benefiting from TransUnion's data orchestration.

- Integration: Offers a single API that can access over 65 risk attributes, simplifying the process of integrating identity, device, and behavioral signals into existing systems.

- Pricing: Pricing is enterprise-oriented and requires a direct sales consultation. Onboarding is more involved than with self-service platforms.

| Pros | Cons |

|---|---|

| Strong US data assets and a large fraud network | Pricing is sales-quoted and enterprise-oriented |

| Public-sector–friendly; FedRAMP Ready assessed | Documentation is spread across multiple product pages |

| Broad product family covering identity and digital insights | Can be overly complex for simple use cases |

Verdict: TransUnion TruValidate is a top-tier choice for large enterprises, financial institutions, and government agencies that require a deeply layered approach to identity verification and fraud prevention, backed by extensive credit and identity data.

12. DocuSign Identify (ID Verification)

DocuSign Identify seamlessly integrates identity verification directly into its world-renowned eSignature workflows. It is specifically designed for organizations where the act of verifying an individual’s identity is intrinsically linked to signing a legally binding agreement, such as high-value contracts, financial agreements, or regulated documents. This solution embeds ID checks within the signing process, creating a single, cohesive audit trail that enhances security and compliance without forcing users onto a separate platform.

The platform supports multiple verification methods, from checking government-issued IDs with liveness detection to knowledge-based authentication and even a 24/7 video agent option for high-assurance scenarios. What makes it one of the best identity verification software choices is its context-specific application. Instead of being a standalone KYC tool, it serves as a critical security layer for the agreement lifecycle, ensuring the person signing is who they claim to be at the exact moment of commitment.

Key Features & Analysis

- Verification Methods: Offers a tiered approach including ID document scanning, biometric liveness checks, and an optional fallback to a live video agent for higher assurance levels like IAL2/QES.

- User Experience: The verification step is a natural part of the document signing flow, which is familiar to millions of users worldwide. The experience is branded and configurable.

- Integration: Natively built into the DocuSign Agreement Cloud, providing a unified and secure record of both the signature and the identity verification within the signed document’s audit trail.

- Pricing: Identity verification features are available as add-ons to DocuSign eSignature plans and are typically metered on a per-use or per-envelope basis.

| Pros | Cons |

|---|---|

| Unbeatable integration for agreement-centric workflows | Not a full, standalone AML/KYC screening suite |

| Strong, unified audit trail for legal and compliance | Identity checks are metered add-ons to existing plans |

| 24/7 certified agent fallback for high-assurance needs | Primarily focused on the point of signature, not general onboarding |

Verdict: DocuSign Identify is the ideal solution for businesses that need to attach high-assurance identity proof to digital agreements, making it perfect for legal, real estate, and financial services.

Top 12 Identity Verification Solutions Comparison

| Vendor | Core features | Key strengths | Target audience | UX / Quality | Pricing |

|---|---|---|---|---|---|

| Stripe Identity | Document + selfie/liveness; hosted & embeddable SDKs; 100+ countries | Tight Stripe integration; transparent pay-as-you-go; fast onboarding | Marketplaces, platforms, US businesses using Stripe | Fast results; good docs; dashboard & webhooks | Pay-as-you-go, free starter quota |

| Veriff | Automated or hybrid AI+human review; liveness; global coverage (230+ countries) | Multi-language support; charges only completed sessions; clear add-ons | Startups to regulated firms needing global reach | Hosted verification pages; analytics; 48 languages | Public per-verification pricing; 15‑day trial; monthly minimums |

| Jumio | ID verification + AML screening; 5,000+ ID types; fraud analytics | Enterprise-grade orchestration; identity graph; high throughput | Large enterprises and high-volume platforms | Scales for high throughput; mature enterprise tooling | Quote-based; add-ons priced separately |

| Trulioo | KYC data & documents; fraud intelligence; 14,000+ templates | Single API/dashboard; strong global reach; flexible checks | Businesses needing broad international KYC/KYB | Modular SDKs; quick integration options | Sales-quoted; best value at scale |

| Persona | Gov ID + selfie + watchlists; no-code flows; case management | Highly configurable; strong investigations tools; pay-per-successful model | Teams needing deep customization & case workflows | Rich case management; developer-friendly docs | Public Essential plan; enterprise via sales |

| Socure | Non-documentary IDV (400+ sources); DocV; device & contact intelligence | High auto-approval for thin-file users; explainability; CIP alignment | US-focused orgs verifying hard-to-verify users | Predictive verification; audit-ready reason codes | Quote-only; advanced modules may bundle |

| LexisNexis Risk Solutions (InstantID + TrueID) | InstantID database matches; TrueID document auth (6,800+ IDs); device signals | Deep US datasets; mature enterprise tooling; frequent updates | Financial services, public sector, regulated use cases | Enterprise-grade, comprehensive signals; complex integrations | Quote-based; may require complex integration |

| Mitek (Mobile Verify + MiPass) | ID capture + authenticity checks; face/voice liveness; SDKs | Longstanding vendor; flexible pricing models; ongoing authentication | Financial services, fintech, marketplaces | Reliable capture tech; enterprise SDKs | Sales-quoted; pay-per-auth or unlimited-user options |

| AU10TIX | ID + liveness; deepfake & injection detection; 180+ forgery tests | Strong anti-deepfake positioning; rapid integration; dynamic workflows | High-risk industries (fintech, crypto, gaming) | Hybrid/manual review tiers; case management | Quote-based; ~$500/mo minimum guidance noted |

| Sumsub | ID + liveness; AML screening & monitoring; reusable Sumsub ID | Transparent self-serve pricing; charged for successful verifications; sandbox | Startups and SMBs needing early AML capabilities | Clear onboarding; reusable ID speeds rechecks | Published per-check rates; monthly minimums ($149–$299) |

| TransUnion TruValidate | ID verification vs TransUnion data; 65+ risk attributes; passive liveness | Large fraud network; FedRAMP-ready assessment; strong US data | Enterprises and public-sector orgs with US focus | Orchestration across identity, device, behavior | Sales-quoted; enterprise-oriented onboarding |

| DocuSign Identify (ID Verification) | Document auth + biometrics; Identity Wallet; optional agent review | Native eSignature integration; audit trails; certified agent fallback | Organizations tying KYC to agreement signing | Friction-right within signature flows; metered add-on | Metered add-on to eSignature plans; sales-quoted for enterprise |

Your Buyer's Checklist and Making the Final Call

Navigating the crowded market for identity verification software can feel overwhelming. As we've explored, solutions from Stripe Identity to Sumsub and Mitek each offer a unique blend of features, compliance frameworks, and user experiences. The critical takeaway is that there is no single "best" platform for everyone; the ideal choice is deeply intertwined with your specific operational needs, risk tolerance, and user base.

The decision you make is more than a simple software purchase; it's a foundational choice that impacts user trust, operational efficiency, and your ability to scale securely. The right partner will not only help you meet KYC/AML requirements but also create a frictionless onboarding experience that converts users rather than frustrating them. Conversely, a poor fit can lead to high abandonment rates, excessive false positives, and a constant struggle to keep up with evolving fraud tactics.

Key Factors to Guide Your Decision

Before committing to a provider, it’s crucial to move beyond marketing claims and assess the practical realities of implementation. The most advanced features are useless if they don't align with your business model or integrate smoothly into your existing technology stack.

Reflecting on the dozen tools we analyzed, several core themes emerge. Specialization is key; a solution like Socure, with its deep roots in financial services, might be overkill for a small marketplace, where Veriff’s user-friendly flow could be a better fit. Similarly, global reach is non-negotiable for businesses with an international audience. A platform like Trulioo, with its extensive GlobalGateway data network, offers a clear advantage here, while others may have more limited regional support.

Ultimately, your selection process should be a rigorous evaluation of how a vendor’s strengths map directly to your weaknesses and opportunities.

Your Final Implementation Checklist

Selecting the right IDV partner is a long-term strategic decision. Before you sign a contract, run through this final checklist to ensure you've covered all critical angles. This systematic approach will help you choose the best identity verification software for your unique context.

- Use Case Alignment: Does the vendor specialize in your industry (e.g., banking, marketplaces, crypto)? A provider with deep experience in your vertical will understand its unique fraud patterns and regulatory nuances.

- Global Reach: Do they support the specific countries and ID document types your users will have? Verify their coverage list and ask about their roadmap for new regions if expansion is a possibility.

- User Experience (UX): Is the capture flow fast, intuitive, and mobile-friendly? Always request a live demo or, better yet, use their sandbox environment to test the end-user journey yourself. A clunky UX is a primary driver of user drop-off.

- Integration & API: Does their technical documentation meet your developers' needs? Are well-supported SDKs available for your required platforms (iOS, Android, Web)? A weak API can turn a simple integration into a major engineering headache.

- Fraud & AI Detection: How robust are their liveness checks and defenses against deepfakes, presentation attacks, and AI-generated ID photos? As synthetic media becomes more sophisticated, this is a critical battleground. Consider augmenting your process with a specialized tool like AI Image Detector to add a privacy-first layer of verification for profile pictures or user-submitted images, ensuring they weren't synthetically generated.

- Pricing Model: Does their pricing structure (per-check, monthly minimums, tiered subscriptions) align with your business volume and growth projections? Be wary of hidden fees for features like ongoing monitoring or specific fraud checks.

- Compliance: Are they certified for essential standards like GDPR, CCPA, and SOC 2? Ask for their compliance documentation to ensure they can meet your legal and security obligations.

By carefully weighing these factors against the detailed reviews in this article, you can confidently choose the best identity verification software for your needs. The right tool will not only secure your platform but also act as a powerful enabler of trust, safety, and sustainable growth.

As you fortify your defenses against fake IDs, don't forget the growing threat of AI-generated profile images and user-submitted content. Strengthen your verification workflow with a specialized tool designed to detect synthetic media. Scan images with the free AI Image Detector to add a critical layer of defense and ensure the people behind the profiles are real.