A Guide to Modern Insurance Claim Fraud Detection

At its core, insurance claim fraud detection is the process of sniffing out and stopping intentionally false claims. It's a mix of smart data analysis, artificial intelligence, and good old-fashioned human investigation to catch red flags and weird patterns. This protects not just the insurance companies, but also every honest policyholder from getting hit with higher costs.

Understanding the Hidden Cost of Insurance Fraud

It’s easy to think of insurance fraud as a victimless crime. A little exaggeration here, a padded claim there—who gets hurt besides a massive, faceless company? That view, however, couldn't be more wrong. Fraudulent claims are essentially a hidden tax on every single honest policyholder, forcing premiums up for everyone to cover the industry's staggering losses.

Strong insurance claim fraud detection isn't about padding a company's bottom line. It's about keeping the entire system fair and affordable.

The numbers are truly eye-watering. Globally, insurance fraud is expected to cost more than $80 billion a year. This isn't just a rounding error; it’s a massive financial drain that directly impacts what you and I pay for coverage. Depending on the type of insurance and where you are, experts estimate that suspicious payouts make up anywhere from 2% to 10% of all claims. You can dig into the global insurance fraud trends to see just how widespread this problem has become.

How Insurance Fraud Has Changed Over Time

Fraud isn't just about someone exaggerating the value of a stolen TV anymore. That still happens, of course, but the real trouble now comes from sophisticated, organized criminal rings that know exactly how to exploit the system for huge paydays.

We're not talking about one-off incidents. These are complex operations, often involving a network of shady collaborators like dishonest doctors, auto repair shops, and even lawyers. Their methods have grown more complex right alongside technology, constantly adapting to find new loopholes.

The core challenge has shifted from catching individual exaggerations to dismantling complex, interconnected criminal enterprises. This requires a proactive, technology-driven approach to stay ahead of evolving threats.

To build a solid defense, you first have to understand the different flavors of fraud. Each one poses its own unique detection challenges.

To make this clearer, let's break down the most common types of insurance fraud you'll encounter.

Overview of Common Insurance Fraud Types

| Fraud Category | Description | Real-World Example |

|---|---|---|

| Opportunistic Fraud | The most common type, where a person pads an otherwise legitimate claim. It's often seen as a small, "harmless" exaggeration. | Adding pre-existing dents to a car accident claim or inflating the value of electronics stolen during a burglary. |

| Planned Fraud | Deliberately causing an incident to file a claim. This is premeditated and often involves staging events. | A "crash-for-cash" scheme where fraudsters slam on their brakes to cause a rear-end collision, then claim fake injuries. |

| Professional Fraud | Highly organized, large-scale schemes run by criminal rings as a business. They exploit systemic weaknesses for massive, repeated payouts. | Creating "ghost clinics" that bill insurers for medical treatments that never happened, often using stolen patient identities. |

This table shows the progression from a simple fib to a full-blown criminal enterprise. It's precisely this escalation that makes modern, robust insurance claim fraud detection an absolute necessity. The old ways of catching fraud just don't cut it anymore.

How Modern Fraud Detection Systems Uncover Deception

To keep up with the sheer creativity of fraudsters, insurers have moved way beyond tedious manual reviews. Modern insurance claim fraud detection now leans on powerful systems that can analyze millions of data points in the blink of an eye. These systems generally fall into two camps, each with its own way of sniffing out a lie.

The classic approach involves rule-based systems. Think of this as a security guard with a very specific checklist. This method uses a set of "if-this, then-that" rules to flag claims. For example, a rule might trigger an alert if someone files multiple, nearly identical claims in a few weeks, or if a claim pops up the day after a policy is activated.

These systems are great for catching common, well-known fraud tactics. They’re straightforward and reliable for the low-hanging fruit. The problem? Their rigidity is also their biggest flaw. Clever fraudsters eventually figure out the rules and learn how to tiptoe right around them, making this method a step behind more complex scams.

The Game-Changer: AI and Machine Learning

This is where the second approach, powered by Artificial Intelligence (AI) and Machine Learning (ML), completely rewrites the playbook. If rule-based systems are the security guards, AI models are like seasoned detectives who have developed a gut instinct over thousands of cases. They don't just follow a checklist; they sense when a story doesn't add up.

AI isn't bound by rigid, pre-written rules. Instead, it’s trained on massive datasets of historical claims—both legitimate and fraudulent. From this data, it learns to identify incredibly subtle, complex, and often invisible patterns of deception. This means it can adapt on the fly, spotting new fraud schemes as soon as they appear.

AI-powered fraud detection shifts the core question from "Did this claim violate a known rule?" to "Does this claim's entire profile—its connections, timing, and details—feel like other fraudulent claims we've seen, even in ways we can't manually define?"

This leap forward allows for a much more dynamic and predictive defense. An AI might flag a claim not because of one big red flag, but because of a unique combination of dozens of seemingly innocent data points that, when woven together, scream "fraud." This is the kind of intelligence needed for modern insurance claim fraud detection.

The Core AI Techniques at Work

Several key AI techniques are the engines behind these smart systems. Each one plays a unique role in finding suspicious activity that a human analyst or a simple rules-based engine would almost certainly miss.

Anomaly Detection: This is all about finding the odd one out. The system first builds a detailed picture of what "normal" claim activity looks like. Then, it flags any claim that strays too far from that baseline. A medical clinic that suddenly starts billing for an unusually high volume of expensive procedures is a classic anomaly this system would catch.

Predictive Modeling: These models act like oddsmakers, calculating a "fraud score" for every incoming claim. By analyzing hundreds of variables—from the claimant's history and the provider's details to the specifics of the incident—the model predicts the statistical probability of fraud. This lets investigators focus their limited time on the highest-risk cases first.

Network Analysis: This is where the real detective work happens. This powerful technique maps out the hidden relationships between all the people and businesses in the claims ecosystem. It connects the dots between claimants, doctors, lawyers, and auto body shops to uncover organized fraud rings. If five different claimants are all using the same doctor and lawyer for suspiciously similar "minor" accidents, network analysis lights up that connection like a Christmas tree.

These models are also getting smarter about analyzing unstructured data, like the photos submitted as evidence. Tiny distortions, pixel inconsistencies, or metadata mismatches in an image can be telltale signs of digital tampering. To get a deeper look into this, check out our guide on how to detect photoshopped images. It adds a crucial layer of digital forensics to the process, ensuring the evidence itself can be trusted.

The Investigator's High-Tech Toolkit

Think of a fraud investigator's job like a detective's. Beyond the big-picture models, their day-to-day work depends on a specialized set of tools—digital magnifying glasses and forensic kits, if you will. These are what they use to dissect a claim piece by piece, hunting for the tell-tale signs of a lie. It's how they turn a mountain of raw data into a clear, actionable lead.

This toolkit has a few different layers. The first is like a wide-net search, sifting through massive amounts of data for any suspicious patterns. The next layer goes deeper, digging into the human side of the claim—the written notes, the submitted photos—which is often where the smoking gun is hiding.

Data Mining for Historical Clues

At the highest level, data mining acts like a criminal profiler for claims. It automatically combs through years of claim histories to find anything that just doesn't look right. With these tools, an investigator can get answers in minutes to questions that used to take weeks of manual digging.

- Frequency Analysis: Is this person filing way more claims than average? Someone with five minor "fender benders" in two years is going to raise a red flag.

- Provider Outliers: Is a particular auto body shop or medical clinic constantly tied to claims that are expensive but minor? Data mining can pinpoint providers who might be padding the bills.

- Geographic Hotspots: Are we seeing a strange number of similar claims coming from the same neighborhood, or even the same apartment building? This could be the work of a staged accident ring.

This is all about flagging the claims that need a closer look, helping investigators focus their energy where it's needed most.

Text Analytics Uncovering Hidden Narratives

The numbers tell one part of the story, but the words—the actual narrative in the claim file—often reveal the truth. Text analytics uses natural language processing (NLP) to read between the lines in unstructured text like adjuster notes, claimant statements, and medical reports.

The system can instantly scan thousands of documents for specific keywords or phrases linked to known fraud schemes. More sophisticated tools can even perform sentiment analysis to spot inconsistencies in tone or contradictions between what a claimant said on day one and what they said in a deposition a month later. It adds a vital human element to the cold, hard data.

Image Forensics Verifying Visual Evidence

We live in a "pics or it didn't happen" world, which means photos are central to most claims. But it also means verifying those photos is absolutely critical. Fraudsters are getting better and better at using doctored or completely fake images to back up their stories. This is why image forensics is no longer optional in modern insurance claim fraud detection.

Today, every photo submitted with a claim must be treated as a potential digital crime scene. Investigators now have the forensic tools to analyze these scenes for fingerprints of manipulation, ensuring that visual evidence is trustworthy.

Investigators come at every image from multiple angles:

Metadata Analysis: Every digital photo has a hidden stash of data called EXIF (Exchangeable Image File Format) data. This tells you the camera used, the exact date and time the photo was taken, and sometimes even the GPS coordinates. If a photo of "storm damage" was actually taken on a sunny day a week before the hurricane, the case is pretty much closed. To see just how much information is packed into an image file, you can explore our guide to check the metadata of a photo.

Error Level Analysis (ELA): This cool technique essentially looks for digital "scars" in a photo. When an image is edited—say, by copy-pasting some fire damage onto a kitchen wall—the altered pixels have a different compression signature than the rest of the original image. ELA makes these manipulated spots jump right off the screen.

Reverse Image Search: It's a simple trick, but incredibly effective. An investigator can run a search for the submitted photo across the entire internet. This can instantly show if the picture of that "crashed" car was actually lifted from a news article, a stock photo site, or even an old claim from another state.

To handle this at scale, many modern systems incorporate automated website screenshot APIs for visual testing and evidence collection, making it easier to document online evidence in a systematic way.

The New Frontier: AI-Generated Image Detection

The latest challenge on the horizon is the explosion of AI-generated images and deepfakes. A scammer doesn't need Photoshop skills anymore; they can just tell an AI to create a photorealistic image of a car crash. To fight this, deepfake detection algorithms are becoming essential. These tools are trained to spot the tiny, almost invisible giveaways that AI models leave behind—things like unnatural lighting, weird textures, or small logical flaws in the scene. It's a proactive defense against the next wave of high-tech fraud.

Building an Effective Fraud Detection Workflow

Having powerful detection tools is one thing, but making them work together seamlessly is what truly stops fraud in its tracks. A successful insurance claim fraud detection system isn't just a piece of software; it's a dynamic, multi-stage workflow. Think of it as an assembly line, where each station adds another layer of scrutiny to catch suspicious claims before they result in a payout.

This process transforms raw, disconnected data into clear, actionable intelligence for investigators. It starts by gathering all the necessary information and ends with a system that learns and gets smarter with every case it reviews. This structured approach is essential for handling the sheer volume of claims while ensuring accuracy and efficiency.

Stage 1: Data Integration and Preprocessing

The entire workflow kicks off with data integration. A claim isn't just a single form; it’s a collection of documents, images, adjuster notes, and historical data. An effective system has to pull all these puzzle pieces together from different sources—like policy databases, claims management systems, and even external public records—into one unified view.

Once collected, the data must be cleaned up. This crucial preprocessing step ensures quality by correcting errors, filling in missing information, and standardizing formats. It’s like a chef meticulously preparing ingredients before cooking; without clean, high-quality data, the final analysis will be flawed, no matter how sophisticated the model is.

Stage 2: Model Application and Scoring

With the data prepared, it's time for the core analysis. This is where AI models and rule-based engines get to work, scrutinizing every detail of the claim. The system applies its learned patterns to assess the likelihood of deception based on hundreds, sometimes thousands, of variables.

The outcome is a fraud risk score. This score isn't a simple "yes" or "no" but a probability—a number that represents how suspicious a claim is compared to millions of others. A low score means the claim is likely legitimate and can be fast-tracked for payment, while a high score signals that a human expert needs to take a much closer look.

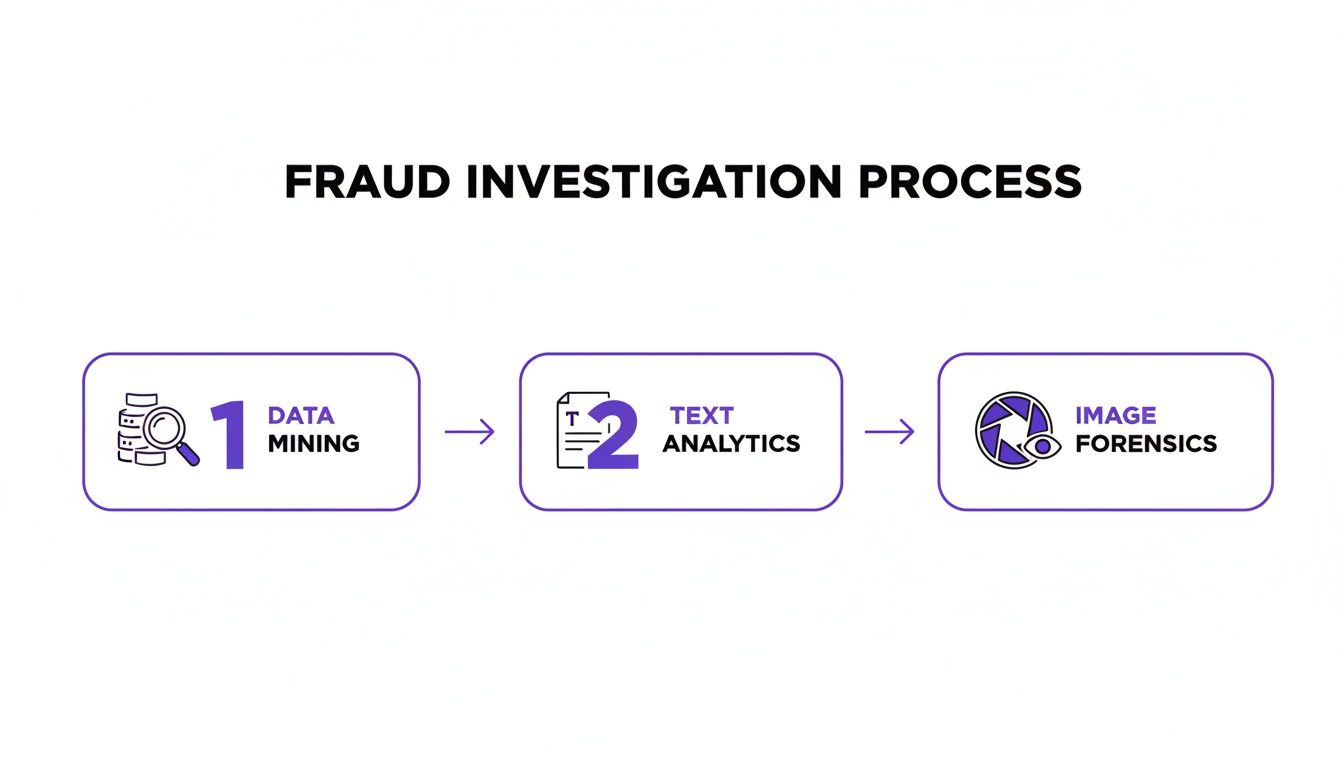

This diagram offers a simplified view of the key analytical techniques often used at this stage.

As you can see, modern systems don't rely on a single method. They blend data mining, text analytics, and even image forensics to build a comprehensive risk profile for each claim.

Stage 3: Triage and Human Investigation

Not every flagged claim is fraudulent. The next stage, triage, is all about prioritizing the highest-risk alerts for human review. This ensures that investigators focus their valuable time on cases that are most likely to be scams, rather than chasing down low-priority flags or false positives.

This is where the "human-in-the-loop" concept becomes vital. The system acts as a powerful assistant, flagging potential issues and organizing all the relevant evidence. But it’s up to a skilled investigator to make the final judgment call, using their experience and intuition to confirm or dismiss the system’s suspicions.

Stage 4: The Critical Feedback Loop

The workflow doesn't end when a case is closed. The final, and arguably most important, stage is the feedback loop. The outcome of every investigation—whether a claim was confirmed as fraud or found to be legitimate—is fed back into the system.

This continuous feedback is the engine of improvement. It allows the AI model to learn from its successes and mistakes, constantly refining its algorithms to become more accurate over time.

This self-correcting mechanism is what makes a modern insurance claim fraud detection workflow so powerful. It adapts to new fraud tactics and reduces false positives, creating a smarter, more resilient defense. The global insurance fraud detection market is projected to grow from $7.5 billion to over $22.9 billion by 2029, a surge driven by the adoption of these intelligent, self-improving workflows. You can read the full research on the market's growth to understand the scale of this industry shift.

6. How Do You Know If It’s Working? Measuring Success and Best Practices

So, you’ve put a sophisticated fraud detection system in place. That’s a great first step, but the real work has just begun. How can you be sure it's actually catching bad actors without hassling your honest customers? It’s not as simple as counting the number of flagged claims.

True success is a balancing act. You need to catch fraudsters, but you also need to ensure the claims process remains smooth for the vast majority of legitimate policyholders. Think of it like tuning a high-performance engine—you can't just floor the gas. You have to monitor several gauges at once to get everything running perfectly.

Key Metrics for Evaluating Fraud Detection Performance

To get a clear, unbiased picture of how well your system is performing, you need to track a few key metrics. These numbers tell the real story, revealing not just how much fraud you're catching but also how efficiently your team is operating and how the system impacts your customers.

Let's break down the most important ones.

Comparing Fraud Detection Evaluation Metrics

When you're evaluating a fraud detection model, you'll hear a lot of different terms thrown around. It's crucial to understand what each one actually tells you—and what it doesn't.

| Metric | What It Measures | Importance/Limitation |

|---|---|---|

| Precision | Out of all the claims your system flagged, what percentage were actually fraudulent? | Importance: A high precision score means your investigators aren't wasting time on false alarms. It directly measures the quality of the alerts. Limitation: It doesn't tell you how much fraud you're missing. |

| Recall (Detection Rate) | Out of all the actual fraudulent claims out there, what percentage did your system successfully catch? | Importance: This is your core fraud capture metric. A high recall means fewer fraudulent claims are slipping through the cracks. Limitation: Chasing a perfect recall score often leads to more false positives. |

| False Positive Rate | What percentage of legitimate claims were incorrectly flagged as suspicious? | Importance: This is a critical customer experience metric. A high rate means you're frustrating honest customers and creating unnecessary work for your team. Limitation: Focusing only on lowering this rate can cause you to miss more actual fraud. |

| Investigator Efficiency | How does the system impact your human team's productivity? (e.g., cases closed per day, accuracy of outcomes) | Importance: The goal is to make investigators more effective, not bury them in alerts. This measures the real-world operational value of your tools. Limitation: It's a business metric, not a direct measure of model accuracy. |

Ultimately, there's no single "best" metric. The ideal system finds the sweet spot: maximizing recall and precision while keeping the false positive rate as low as possible. This balance ensures your investigators focus their valuable time on genuinely suspicious cases, which is a win for everyone.

The Power of the Human-in-the-Loop

One of the most important lessons in modern fraud fighting is this: technology is a tool, not a replacement for human expertise. This is the core of the "human-in-the-loop" approach.

The goal isn't to have an algorithm make final decisions in a black box. Instead, the tech should do the heavy lifting—sifting through millions of data points and flagging the subtle anomalies that the human eye would miss. This frees up your skilled investigators to apply their experience, intuition, and critical thinking to the most complex and high-risk cases.

Technology finds the needle in the haystack; the human expert confirms it's actually a needle. This partnership is the cornerstone of any effective, modern fraud investigation.

This collaborative model keeps you from blindly trusting an algorithm and ensures that the nuance of a complex claim gets the expert judgment it deserves.

Operational Best Practices for Long-Term Success

Beyond the tech and the metrics, building a resilient fraud-fighting operation comes down to culture and process. Fraudsters are always evolving their tactics, so your defense has to be just as dynamic.

Establish a dedicated Special Investigation Unit (SIU): This isn't a job for a generalist. A dedicated, highly-trained SIU acts as the central nervous system for your entire fraud detection effort, handling the most complex cases that your system uncovers.

Build a company-wide culture of awareness: Fraud isn't just the SIU's problem. Everyone from underwriters to customer service reps is on the front lines. Training them to spot red flags creates a powerful, multi-layered defense that technology alone can't replicate.

Never stop refining your models: Fraudsters don't stand still, and neither can your models. You have to commit to regularly retraining your AI with new data and, most importantly, the confirmed outcomes from past investigations. In an industry like property and casualty insurance, where an estimated 10% of all claims have fraudulent elements, this cycle of continuous improvement is absolutely non-negotiable.

To dig deeper into the financial impact and how AI is helping, you can discover more insights about AI's role in fighting insurance fraud from Deloitte.

Navigating the Legal and Ethical Maze

Rolling out a powerful insurance claim fraud detection system is about more than just technology. It's a deep dive into a tricky world of laws and ethics. While these advanced tools are brilliant at spotting deception, they come with heavy responsibilities around fairness, privacy, and accountability.

Data privacy is right at the top of that list. Regulations like Europe's GDPR and California's CCPA draw firm lines around how personal data can be gathered, kept, and analyzed. An insurer can't just dump all claimant data into a model without a solid legal reason and crystal-clear policies.

This means every single step, from the moment data is collected to the final analysis, has to be by the book. Dropping the ball on sensitive information doesn't just open the door to huge fines; it shatters the trust between a policyholder and their insurer. It's crucial to understand how AI, risk management, and legal rules all intersect. You can learn more about this intersection here: https://www.aiimagedetector.com/blog/regulatory-compliance-risk-management.

Upholding Fairness and Avoiding Algorithmic Bias

Beyond the privacy rules, the danger of algorithmic bias is a massive ethical landmine. An AI model is a reflection of the data it learns from. If that historical data is laced with old societal biases, the model can easily learn to flag claims from certain groups of people unfairly.

For instance, a model might start associating specific zip codes or even certain doctors with a higher fraud risk, not because it's true, but because of skewed data from the past. To stop this from happening, insurers have to be on the front foot.

- Audit Training Data: Proactively comb through historical claims data to find and fix any built-in biases before the model ever sees it.

- Ensure Model Transparency: Embrace "explainable AI" (XAI) methods to get under the hood and understand why a model flagged a claim. This prevents decisions from being made inside a mysterious "black box."

- Regular Fairness Testing: Constantly check how the model performs across different demographic groups to make sure it's treating everyone equitably.

Maintaining a Defensible Evidence Trail

At the end of the day, any fraud findings have to stand up in a legal setting. An AI's risk score is a starting point, not the final word. For every claim that gets denied or pursued because of a system alert, you absolutely must have a clear, defensible trail of evidence.

This means documenting the entire investigation that kicks off after an automated flag is raised. A well-structured fraudulent charge report form can be an excellent resource for formally documenting potential fraud. Keeping these meticulous records ensures that every decision is justifiable and legally sound, protecting both the insurer from liability and the claimant from an unfair fight.

Common Questions About Fraud Detection

As the tech for spotting insurance fraud gets smarter, it's understandable that people have questions. Insurers and policyholders alike want to know how it all works, what it means for them, and what guardrails are in place. Let's break down some of the most common queries.

Will My Premiums Go Down if Fraud Is Reduced?

That's the goal. A chunk of every premium dollar you pay goes toward covering losses from bogus claims. When an insurer gets good at shutting down fraud, their total claim payouts drop.

Those savings can then be passed along to customers, leading to more stable or even lower premiums. While a lot of things go into setting insurance rates, fighting fraud is one of the most direct ways to keep costs down for everyone.

How Do Systems Handle New or Evolving Fraud Tactics?

This is where modern AI and machine learning really make a difference. Old-school, rule-based systems could only catch what they were specifically told to look for. AI models, on the other hand, are built to learn and adapt on the fly.

By constantly crunching new claim data and seeing how investigations turn out, these systems spot new, unusual patterns and weird connections. This means they can flag brand-new fraud schemes as they emerge, instead of playing catch-up after the fact.

This ability to adapt is absolutely essential for staying a step ahead of fraudsters.

Can a Claim Be Denied by an AI Alone?

Absolutely not. At least, not by any reputable insurer. Think of the technology as an incredibly sharp screening tool, not a final judge. Its job is to highlight claims that need a second look from a human expert.

When a claim gets a high fraud score from the AI, it gets kicked over to a human investigator for review. The final call—to approve, delay, or deny the claim—is always made by a person after digging into the details. This "human-in-the-loop" process is critical for ensuring fairness.

What Is a False Positive and Why Does It Happen?

A false positive is when a perfectly legitimate claim gets flagged as potentially fraudulent. While today's systems are incredibly accurate, they aren't flawless.

It can happen when an honest claim has unusual details that just happen to look like patterns from past fraud cases. For instance, maybe someone has had a string of bad luck with several unrelated, but legitimate, claims in a short period. That might raise a flag.

Insurers are always working to fine-tune their systems to reduce these false positives, so honest customers don't get stuck in unnecessary delays. That's another reason why having a human investigator review every flagged claim is such a non-negotiable part of the process.

At AI Image Detector, we provide the tools to verify the authenticity of visual evidence, a crucial step in modern fraud investigations. Our advanced detection models can instantly determine if a photo has been AI-generated, helping you build a stronger, more reliable claims process. Detect AI-generated images for free.